A Surface Use Agreement (SUA) is a contract between the surface owner and the lessee (usually oil & gas company) to an oil and gas lease. This contract outlines the rights, duties, and obligations by both the landowner and operator including things like the size of the surface disturbance that will be allowed when constructing well pads and roads, compensation for any property damage that might be done by the operator. This agreement helps resolve any ambiguity and uncertainty for both parties. Some states require them before a well can be drilled. Listen to this episode to learn how to negotiate a Surface Use Agreement (SUA).

Using the embedded player above, you can download the episode to your computer or listen to it here! Be sure to also subscribe on iTunes or wherever you get your podcasts and please leave us an honest rating and review. We read every one of them and sincerely appreciate any feedback you have. To ask us a question to be featured on an upcoming episode, please leave a comment below or send an email to feedback@mineralrightspodcast.com.

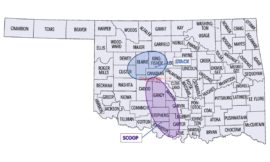

Most states provide oil and gas operators with access to the surface estate overlying any reservoir to be drilled. The mineral estate is sometimes called the “dominant estate”. In other words, the mineral estate is entitled to the right of accessing the surface estate for the purposes of accessing hydrocarbons below ground. This gets complicated with advent of horizontal drilling since minerals below the surface well pad may not actually get developed since producing zones may be under other tracts.

Some states have passed legislation to help navigate this which we’ll talk about later.

To understand the things you should consider when negotiating a Surface Use Agreement, it helps to understand what types of activities are going to happen on your land as part of drilling a well. In Episode 15 of the Mineral Rights Podcast we talk about the full lifecycle of an oil and gas well and the typical activities involved.

Many states have passed legislation that requires oil and gas companies to take certain steps when faced with a split estate. A few examples of states that have done this includes Colorado, Wyoming, and North Dakota.

These protections require notifying surface owners of things like date of the start of drilling, a copy of the plan of operations, contact information for the operator, etc. They also require compensation for certain surface disturbances like pipeline installation.

If the operator and surface owner can’t reach an agreement on damages, some states grant the operator the right to proceed with the development with damages to be determined through arbitration or litigation after the fact.

In no particular order, here are things to consider when negotiating a Surface Use Agreement. Remember that pretty much everything is on the table for negotiation as it relates to water usage, land usage, and leasing your minerals.

Make sure the terms of SUA don’t negatively impact your ability to use your land!!

In general, the SUA will outline the permitted and prohibited activities by all parties to the agreement. No matter what side you are on, make sure any agreements are in writing to avoid any later conflicts.

The dominant estate is no longer something operators can hang their hats on due to horizontal drilling

It is best to approach the SUA negotiations with your goals in mind so you end up with an agreement you can live with.

We’ll have a legal expert dive deeper but in the meantime we hope this helps shed some light on this subject.

Subscribe and leave a review on iTunes or wherever you get your podcasts – we read each one and greatly appreciate it. Plus, you can get a shout out on a future episode!

Thanks again – until next time!

October 14, 2020

July 22, 2021

Welcome to the Mineral Rights Podcast! If you are a mineral rights owner and have questions about leasing, lease offers, drilling, taxes, production, royalties, division orders, or purchase offers then you've come to the right place. Get answers to all of your questions about mineral rights, royalty interests, leasehold interests and more!

Our email content is full of value, tailored to your interests whenever possible, and always free.