"The W Tax Group helped with our HUGE tax issue. They responded quickly to questions or emails and treated us fairly and professionally. They are a honest hard working group that you can count on to help with your tax issue." ~ Jenny Witt

"The W Tax Group is totally awesome!! Gave me valuable information on a free consultation! Even though it is a matter that her company doesn't handle." ~ Latrice Fitzgerald

"This team of people are the very best company I have ever experience. They help me and my company with New York State taxes. They was with me from the beginning to the end. I will recommend this company to anyone with any tax situation. Again I thank you all." - Denise Caldwell

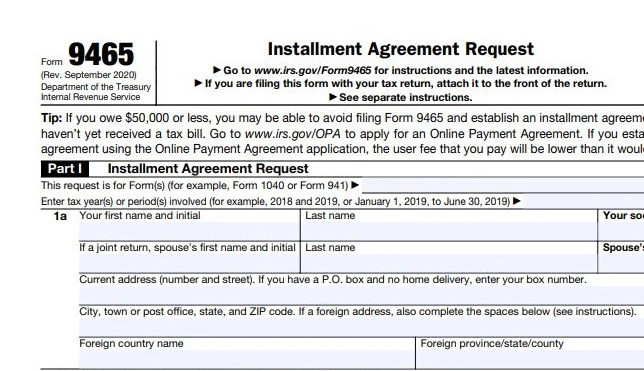

If you owe back taxes, you can use Form 9465 (Installment Agreement Request) to apply for an IRS installment plan through the mail, or you can call the IRS with the info on this form. This form also gives you a good idea of the information you need to request a payment plan online. To help you prepare, this guide explains the basics of the IRS’s installment agreement request form.

Need help navigating this process? The tax attorneys at The W Tax Group have extensive experience helping our clients set up payment plans or making other arrangements with the IRS. To get help with back taxes, contact us today.

Key Takeaways

Individual taxpayers who owe income tax on Form 1040 or 1040-SR can use this form to request an installment agreement. This is also an option for those who owe employment taxes related to a sole proprietorship that is no longer in operation and those who may be responsible for paying a trust fund recovery penalty.

Form 9465 is not suitable for taxpayers who can pay the full amount within 180 days, as they will need to pay fees to send in this form–they can save money on those fees by simply calling the IRS directly or applying online if they owe less than $100,000. You cannot use Form 9465 if your operational business owes employment or unemployment taxes.

The amount of debt may also determine whether or not you have to file this form. If your balance due is greater than $50,000 and you want to request a long-term installment agreement, you must fill out this form because you cannot request a payment plan online.

Part I of Form 9465 requires the basic information the IRS needs to set up a payment agreement. Be prepared to note the following details:

You need to include your routing and account number if you want to make payments through direct debit. You can also use this form to request to have your payments withheld from your paycheck.

The earlier you submit your installment agreement form, the better. The longer you wait to address your tax debt, the more time you’ll incur penalties and the more likely it is the IRS will take action against you for your tax debt.

You should use the Form 9465 instructions to figure out where to send this completed form, as the address depends on where you live and which schedules you filed with for the tax year in question.

Form 9465 helps you calculate the minimum payment the IRS will accept on your payment agreement. To find the minimum payment, subtract any payments you are including with the application from your total balance due. Then, divide the result by 72. These calculations show you the monthly payment if you take six years to pay off your back taxes.

For instance, if you owe $15,400 and include a down payment of $1,000, your minimum monthly payment will be $200. Ideally, you should pay a little more than this to ensure your payment also covers interest and penalties.

If you cannot afford to make the minimum payment, the IRS will not necessarily reject your application. However, you will have to provide the agency with additional information, generally with a 433-F as explained below.

If you’ve calculated your minimum monthly payment and it’s too high for your budget, you should not attempt to move forward with an installment agreement. When taxpayers do this, they do so hoping that they can make up the difference long enough to pay off their debt. In reality, it usually ends with the taxpayer defaulting and then owing the IRS payment in full.

If your budget cannot accommodate the minimum monthly payment, consider working with The W Tax Group on one of these options:

The IRS requires some taxpayers to include additional information on this form. If you cannot afford to pay the minimum amount, you have defaulted on an installment agreement in the last 12 months, and you owe over $25,000, you need to include the following details in Part II (Additional Information) of Form 9465:

This information allows the IRS to get a better sense of your income and obligations. Some taxpayers may also have to include Form 433-F with their payment plan requests.

The following taxpayers need to file Form 433-F (Collection Information Statement) with Form 9465:

Form 433-F requires detailed information about your assets, debts, income, and expenses. It gives the IRS a more complete look at your finances so the agency can make an informed decision about your payment plan request.

If desired, you can request to make your installment agreement payments through a payroll deduction. With this option, your employer withholds the payments directly from your paycheck and sends them to the IRS on your behalf.

To make this election, tick the box on line 14 of Form 9465. This is at the bottom of page one, above your signature. Then, include Form 2159 (Payroll Deduction Agreement) with your application. This form has sections for both you and your employer to fill out.

The IRS charges a user fee to taxpayers who are applying for an installment agreement. As of 2024, the user fee is $107 if you set up direct debit and $178 if you want to pay by any other method. If you apply for an installment agreement online instead of with Form 9465, the fees are just $22 and $69 respectively.

To have the fee waived, tick the box on line 13c. The IRS waives the user fee for low-income taxpayers who qualify if they set up direct debit. If you qualify for low-income and cannot set up direct debit, the fee is $43, but the IRS may reimburse your user fee at the end of your installment agreement.

Yes, you can e-file Form 9465. If you have a professional file your tax return, they should be able to e-file this form along with your return. A lot of individual tax prep software also has an option that allows you to e-file this form when you e-file your return.

However, you cannot e-file this form if it’s not attached to a tax return. In that case, you can apply online if you qualify to do so. Otherwise, you will need to print and mail this form, or call the IRS with the info.

Many taxpayers can request an installment agreement by applying online. This is also considerably less expensive than sending in Form 9465. The IRS also accepts applications over the phone. Call the number on your most recent notice from the IRS, but have the information request on Form 9465 ready. You may find it helpful to fill out Form 9465 and have it on hand when you call so you don’t have to search for information during your IRS call.

Both Form 9465 and the OPA have the same goal—to let you apply for a payment plan. Both request the same info, but if you apply online, you will pay a lower setup fee. However, you can only use an OPA if you owe less than $50,000 ($100,000 if you can pay in 180 days). Taxpayers with any level of tax debt can use Form 9465.

While the process of applying for an installment agreement is straightforward for many applicants, there are situations that call for assistance from a tax pro. First, if you are at all unsure about whether or not your current situation qualifies, talking to a tax pro can be helpful–otherwise you may spend time and money filling out forms that do not apply to your situation and won’t get you any closer to a resolution.

If you calculate your minimum monthly payment and it’s either more than you can afford or close to more than you can afford, we recommend talking to a tax professional. When a monthly payment stretches your budget, it’s very easy to fall behind on payments. At that point, the IRS terminates the installment agreement and you’re back at square one.

Many taxpayers who find themselves in this situation later discover that they could have qualified for an offer in compromise or another option that may have saved them money–and helped them avoid the stress of too-high monthly payments. If you’re not completely certain that an installment agreement is the best way forward for you, talk to a tax pro about your other options.

Dealing with back taxes can be overwhelming and confusing, but the tax attorneys at The W Tax Group can help you. We can apply for a payment plan or help you identify other resolution options for your situation.

Don’t let the IRS start advanced collection actions on your account. Get help now — contact us today.